Vat Overseas Reverse Charge Not Registered For Uk Vat

Vat Overseas Reverse Charge Not Registered For Uk Vat - WebVAT on services from abroad. If your business buys services from outside the UK a rule called the ‘reverse charge’ applies. Convert the value of the services into sterling.. WebWS3 now sells the mobile phones to a taxable person registered for VAT outside the UK for a VAT-exclusive value of £9,000. WS3 does not charge VAT on the supply as this. WebThe reverse charge applies where: •the place of supply is the UK. •the supplier belongs outside the UK. •you belong in the UK. •the supply is not exempt (this. Web29th Aug 2019 22:24. Where the supplier is not registered, the Reverse Charge is still applicable. This is because of the Place of Supply rule, which moves the. WebThat is the reverse charge system in a nutshell. VAT registration threshold. A twist to the tale that applies to services purchased from abroad but not in other reverse.

WebThe reverse charge applies where: •the place of supply is the UK. •the supplier belongs outside the UK. •you belong in the UK. •the supply is not exempt (this. Web29th Aug 2019 22:24. Where the supplier is not registered, the Reverse Charge is still applicable. This is because of the Place of Supply rule, which moves the. WebThat is the reverse charge system in a nutshell. VAT registration threshold. A twist to the tale that applies to services purchased from abroad but not in other reverse. WebWhen must I register for VAT? The UK threshold is set at £85,000. However, it is based on a 12-month rolling period so not just for the fiscal year 6 th April to 5 th April (the UK tax. WebThe reverse charge (or “tax shift”) applies in a cross-border context to services provided by an overseas supplier to a UK business, or by a UK business to an overseas.

Web29th Aug 2019 22:24. Where the supplier is not registered, the Reverse Charge is still applicable. This is because of the Place of Supply rule, which moves the. WebThat is the reverse charge system in a nutshell. VAT registration threshold. A twist to the tale that applies to services purchased from abroad but not in other reverse. WebWhen must I register for VAT? The UK threshold is set at £85,000. However, it is based on a 12-month rolling period so not just for the fiscal year 6 th April to 5 th April (the UK tax. WebThe reverse charge (or “tax shift”) applies in a cross-border context to services provided by an overseas supplier to a UK business, or by a UK business to an overseas.

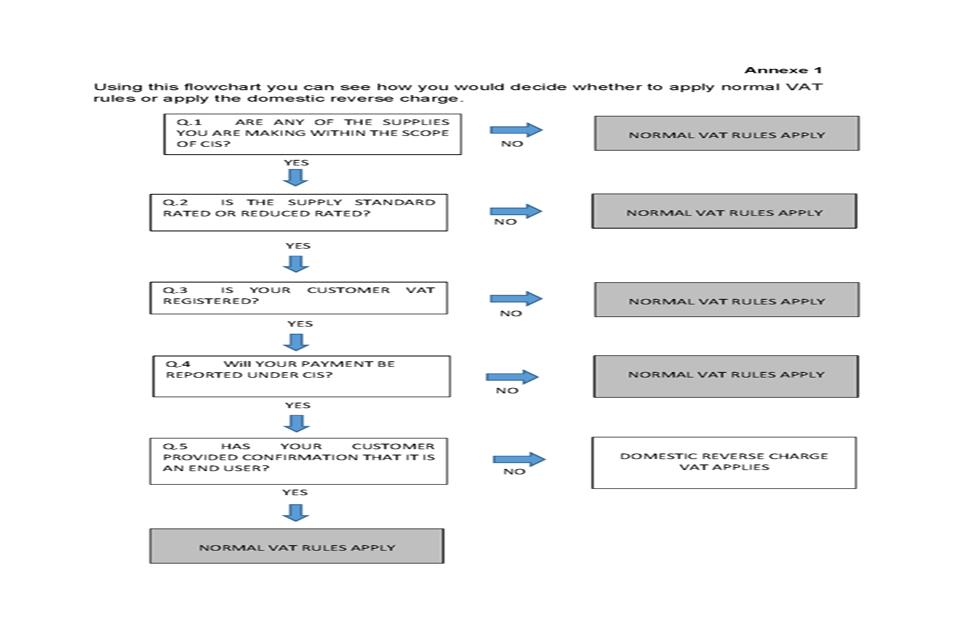

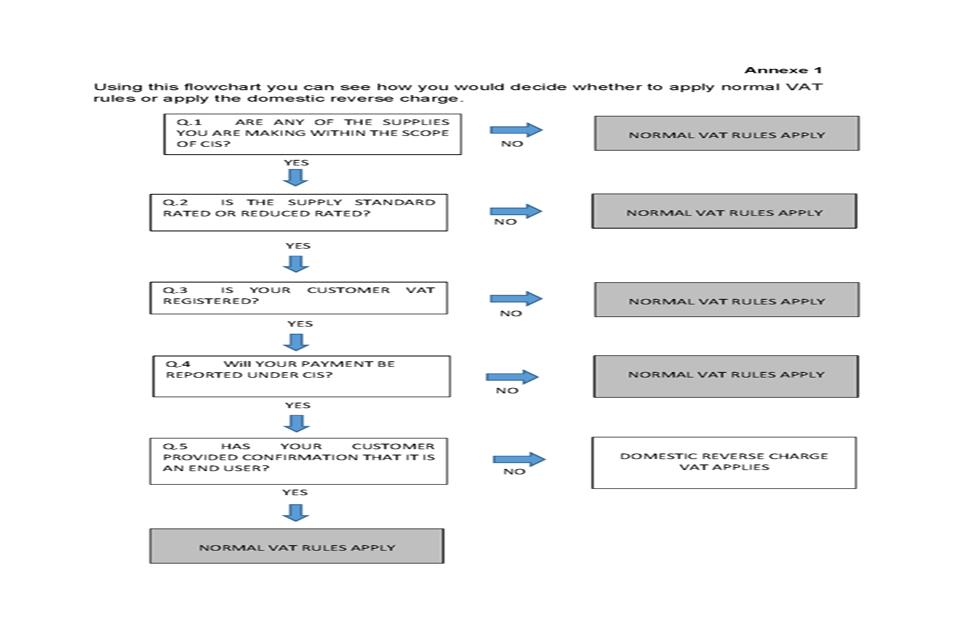

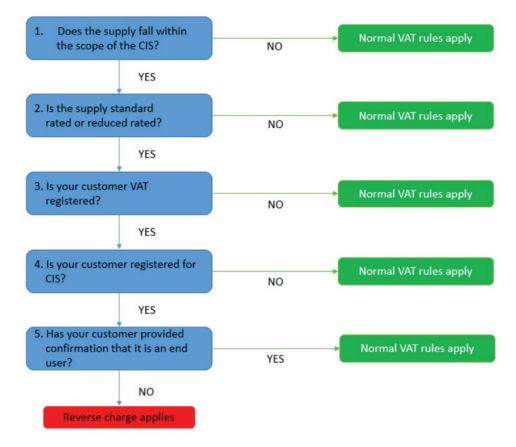

VAT Reverse Charge For Building And Construction Services

VAT Reverse Charge: Should You Be Concerned About Your Cash Flow? - Sales Taxes: VAT, GST - UK

I have to charge myself VAT?! - Marcus Ward Consultancy Ltd

EC reverse charge - Accounting - QuickFile

Post-Brexit VAT rules for services | Taxation

WebWS3 now sells the mobile phones to a taxable person registered for VAT outside the UK for a VAT-exclusive value of £9,000. WS3 does not charge VAT on the supply as this. WebThe reverse charge applies where: •the place of supply is the UK. •the supplier belongs outside the UK. •you belong in the UK. •the supply is not exempt (this.

Belum ada Komentar untuk "Vat Overseas Reverse Charge Not Registered For Uk Vat"

Posting Komentar